Fundraising: An Iraqi Perspective

Written by: Ali Al Suhail, Managing Director at KAPITA, a development company that invests and incubates startups in Iraq. He is also the network manager for the Iraqi Angel Network

The fundraising environment in Iraq is getting exciting. Following the big news of Lezzoo securing a seven figure investment round, we are starting to see more activity with Iraq Tech Ventures leading a six figure investment round into Alsaree3/Zajil and Lezzoo acquiring Erbil Delivery. These activities increasingly validate the potential of the Iraqi market.

There are some interesting takeaways from what we saw so far:

Investments are geared toward B2C startups models in the e-commerce and last mile delivery spaces,

Most investors are diaspora based or foreign investors with established operations in Iraq, and

Targeted startups that are at their Series A stage, i.e., startups with a validated product / market fit, well-established tech and clear business model.

The last point is well understood given the inherent risk and volatility in the Iraqi market with investors seeking to invest in businesses with well-established operations and validated business models.

On the other hand, we are seeing an increase in support for companies at the concept and idea validation phase. IOM announced a grant program for Iraqi startups through its Enterprise Development Fund-Innovation, Orange Corner Baghdad has accepted its second cohort and AUIS announced the Takween accelerator. All of these programs are funded by donors and multilateral organizations. Those programs will serve as a great pipeline for innovative and exciting startups to address the many problems existing in Iraqi markets.

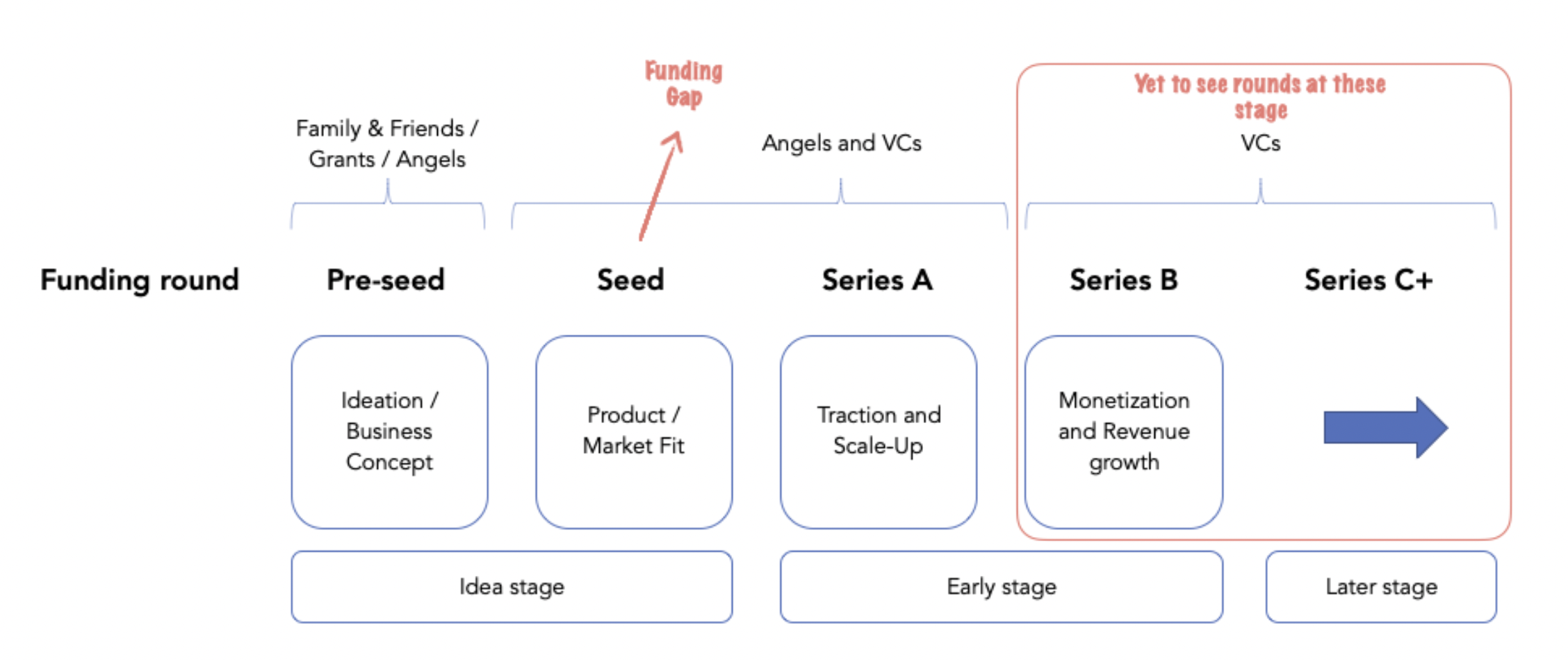

The intersection of investors’ appetite for Series A startups and development organization support for Pre-seed startups create a gap for startups at the Seed stage. We see many strong founders with exciting ideas that fail to build a business around them due to the ambiguity around funding. Founders with no path to funding end up resorting to building cheap technology infrastructures and overreliance on freelancers within key functions of the business. The end result is a shaky operating model built up on a weak technology that breaks a part with as soon as it scales. To address this gap, we have recently launched the first Iraqi Angel Investors Network to help all companies but give special attention to business at this stage. This is a space that can benefit immensely from investments from local entrepreneurs and investors as ticket sizes are small and founders can benefit from their networks and local knowledge.

Founders have a role to play as well to address this gap. There are few things they can do to de-risk their business and make it more attractive to investors.

Register the business: Investors are very wary of the legal complexities of investing in a business without a legal form. It is well understood that business registration is a lengthy and costly process, but founders need to at least start the process before tapping investors.

Build in-house tech capabilities: When tech is a key core of the business, you need to build it in-house. You can outsource some component of your tech but ultimately you will need in-house talent to manage and maintain this front. Investors are more comfortable investing in startups with strong in-house tech talent.

Leverage your equity: The most two important factors that will determine the startup success are the team and the market. In the initial days of the business paying a good salary is improbable, but founders can lure in strong talents with equity stakes.

Prepare to fundraise: As part of your fundraising, you need to create documents to market your business. Investors will look at your pitch and business plan as a reflection of your business and ambitions. Founders need to produce high quality documents with clear articulation of their ideas, plans and the target market.

Understand your strengths: In a business early day, every person on your organization chart needs to have a key role in the business including you. Founders cannot hide behind the CEO title and need to clearly demonstrate their value add to the overall business.

Fundraising is a difficult task anywhere in the world and it is especially difficult within Iraq given the dynamics and the volatility of the market. Founders need to build an awareness on the challenges and dynamics associated with fundraising.

We expect to see more fundraising news coming out of Iraq prior to the end of this year. As more investors enter the last mile delivery and e-commerce spaces, we expect new investments to come into other areas in the market. We are seeing many startups looking to address challenges in the healthcare value chain in Iraq. There are another two sectors that are receiving international attention but have yet to see any real startup activity; Agriculture and Fintech. Fintech is of special interest as innovation in this space to help transform the cash culture in Iraq and move consumers toward online payment will have an immense impact on the ecosystem as a whole. Things are about to get interesting!